Notes issued by this series will aim to shield investors from potential market downturns by providing capital protection whilst aiming to deliver 100% upside participation of the S&P500 Index over a three-year period, so that regardless of the index' performance, your original capital investment is preserved when the note matures.

The Standard and Poor's 500 or S&P500, is a stock market index that tracks the share price performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and is widely regarded as a benchmark for the overall health of the US stock market and serves as a representation of the broader economy.

Investing in the S&P500 is a popular strategy because of the wide market breadth of the large-cap companies included in the index from a broad variety of different sectors such as technology, finance, healthcare and consumer goods. Some well-known companies that are part of the index include Apple, Microsoft, Amazon, Meta, JPMorgan Chase, Johnson & Johnson, Procter & Gamble, Coca-Cola and Exxon Mobil.

Diversification through this index helps to mitigate the impact of sector-specific volatility and aims to mitigate the risks associated with any one sector's poor performance over a given period. Even if one sector is underperforming, the positive performance of other sectors can help offset any potential losses. This diversification can provide a more stable investment over the medium to long term, particularly for investors who prefer a more passive investment approach.

Whilst this level of diversification serves to manage some of the risks associated with equity investment there is always the potential for a market correction that could result in substantial losses. The objectives of the Principal Protected S&P500 Tracker are to deliver 100% participation of the S&P500 over a three-year period with capital protection, so that if a sizeable market correction occurs, the principal amount invested will still become payable on maturity.

This financial instrument has been designed to appeal to risk-averse investors who expect to hold the asset through to maturity and wish to have the added security of knowing that protection for capital loss is mitigated.

About the Capital Protected S&P500 Index Tracker

The Capital Protected S&P500 Index Tracker is a unique financial instrument that combines the growth potential achievable by investing in the S&P500 Index coupled with the peace of mind of capital preservation.

The Capital Protected S&P500 Index Tracker is a structured product involving derivative components. Investors should make sure that their advisors have verified that this product is suitable for their portfolio taking into account the investor's financial situation, investment experience, risk appetite and investment objectives.

The issuer is UK regulated financial Institutional that has a Standard & Poor’s Rating of BBB.

Full information of this offering is detailed in the brochure

Illustrative Scenarios

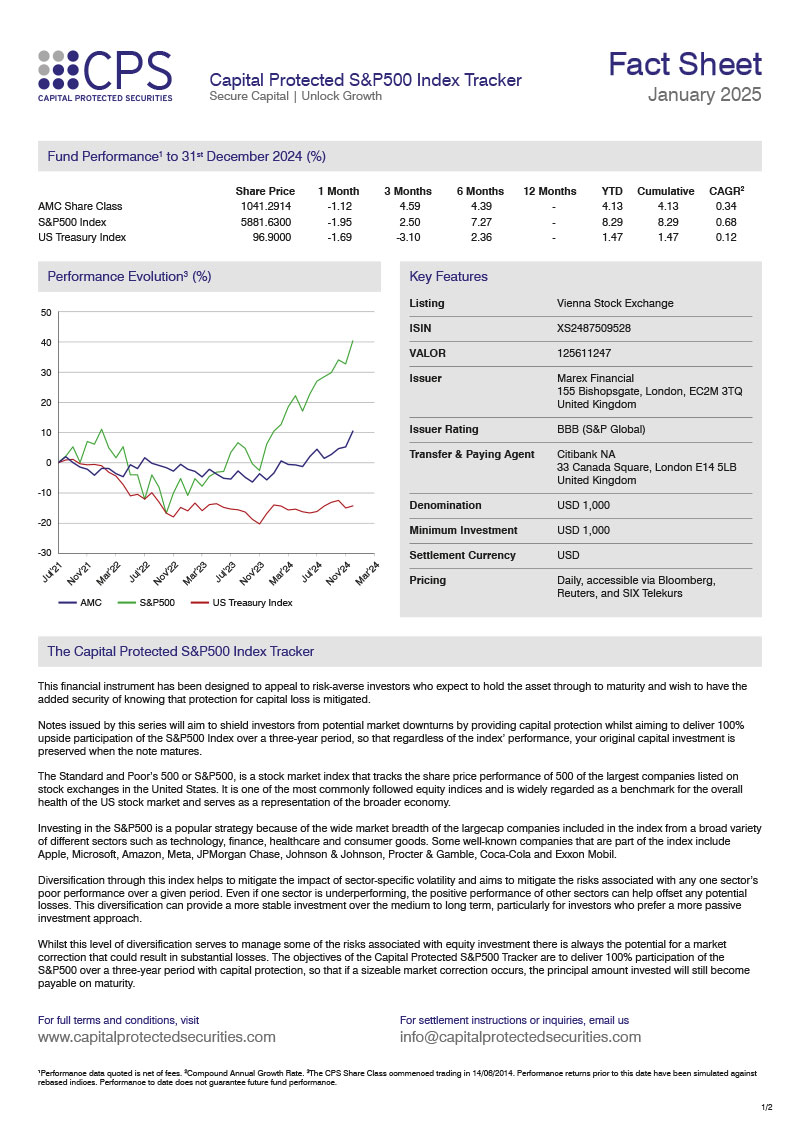

Performance of the S&P500 Index Over the Last 10 Years

Pricing

The Capital Protected S&P500 Index Tracker is denominated in US Dollars and has daily pricing.

Full details of the charges and pricing are detailed on the brochure which is available to eligible investors here

How to Invest

The process to invest in the Capital Protected S&P500 Index Tracker is a relatively straightforward exercise that most professional investors will be familiar with. It is done in the same way as purchasing other shares or bonds that are listed on a stock exchange, through your account with a custodian bank or stockbroker by quoting the ISIN code XS2487509528.

Settlement Instructions are available to eligible investors by email us at info@capitalprotectedsecurities.com

This investment is only available to sophisticated investors. Before you issue an instruction to invest you must read the prospectus and the term sheet to ensure that you fully understand the terms and conditions, the risks involved and that you are eligible to invest.

How to Redeem

There is an active secondary market for the Capital Protected S&P500 Index Tracker as it is listed on the Vienna Stock Exchange.

The maturity date for this security is the 21st of May 2027. Each Investor will be automatically redeemed on the target redemption date which is the 14th of June 2027.